Credit Score 401

The Five Factors That Affect Your Credit Score

Whether you’re looking for an apartment, a car, a new credit card, or utilities setup for a new home, your credit score is a big deal. It impacts so many of your financial choices. That’s why it’s so important to understand what goes into your score, and ways to improve your credit score if you need to.

So what is a credit score? And what’s a good credit score? We’ll look at the most commonly used credit score known as the FICO score, used by about 90% of lenders (a secondary scoring system called a Vantage score is much less common). FICO scores range from 300 to 850. Any score less than 570 is considered poor; scores around 670 and above are good. Your score helps lenders assess how much risk is involved in lending to you.

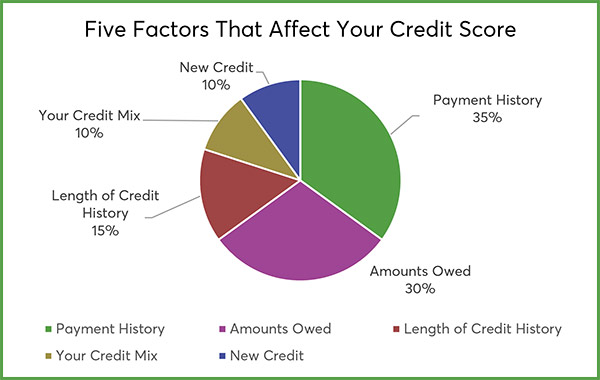

Let’s look at the factors affecting your FICO score: payment history, amounts owed, length of credit history, credit mix, and new credit. We’ll cover each in-depth and explain how the factors are weighted as part of your total score.

Payment History (35%)

Your payment history is just what it sounds like: your history of paying your bills. It factors in questions like, do you always pay? Do you pay on time? If your payments have been late, how late are they? Has anything been sent to collections?

Payment history is the biggest influencer of your credit score. Lenders use this information to predict whether you’re likely to repay them.

Amounts Owed (30%)

Amounts owed looks at how much you owe across all your accounts. It also looks at your credit utilization rate or ratio, which is how much you owe versus how much you can borrow, usually expressed as a percent. Amounts owed is the second most important factor in your credit score.

The report will evaluate each loan, credit card, or line of credit you have. It looks at the ratio for each account individually, as well as all your accounts as a total dollar amount and overall utilization rate.

Generally, you want your credit utilization rate to be 30% or less of what’s available to you. When a lender sees you maxing out your available credit or using higher percentages, it can make you appear to be a risky customer for a lender.

Length of Credit History (15%)

The length of credit history will look at the age of your oldest credit account, the age of your newest account, and the average of all your accounts combined. This tells a prospective lender how long you’ve been managing your credit. In combination with the other factors, this also gives the lender a picture of whether you’ve responsibly managed credit over time.

Usually the longer your credit history, the higher your score will be.

To maintain the length of your credit history, think twice before canceling old cards. It’s often better to let an unwanted card go inactive and keep it in a safe place than to cancel it, which can negatively affect your length of credit history and thus your credit score.

New Credit (10%)

Any time you open a new line of credit account, a “hard inquiry” is registered on your credit report. If you have lots of these in a short period of time, lenders may perceive you as a riskier customer. Every time a hard inquiry occurs, it stays on your credit report for two years – and temporarily lowers your credit score.

There is a type of exception: when looking for the best deal on an auto loan, student loan, or mortgage. In these cases, multiple inquiries over 30 to 45 days get lumped together into one inquiry once you apply.

Your Credit Mix (10%)

Having a variety of different types of accounts – credit, installment loan, line of credit, mortgage, auto loan, etc. – can help your credit score. A good credit mix shows potential lenders you know how to balance a variety of obligations and manage your payments. Don’t open any accounts you don’t really need, though, since each account causes a “hard inquiry” check of your credit report and lowers your score temporarily.

Keep in mind, you can always check your own credit report and credit score without a hard inquiry. This does not impact your credit, and it’s an important way to stay on top of what’s happening with your score.

FAQs: Five Factors That Affect Your Credit Score

Where and how do I check my credit score?

You can check your credit scores for free at AnnualCreditReport.com. Credit Karma, Lending Tree, Experian, and many banks and credit card issuers also give you free access to your score. See Monitor Your Credit Score for Free for more information.

How do I increase my credit score?

Look at your report regularly to help prevent fraud, and dispute any inaccurate information. Check out How To Improve Your Credit Score for more information.

What hurts your credit score?

Closing old accounts, opening lots of new accounts at once, using more than 30% of your available credit and other things referenced in the article above can hurt your credit score.

What’s the best way to build credit?

The best way to build credit is to pay your bills on time. See the article above for more information.

Your credit score doesn’t have to be a mystery. With consistent, on-time payments and smart choices, you can develop a great credit score that works for you.

Editorial Policy: The information contained in Check `n Go’s Finance Academy Learning Center is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Check `n Go does not act as a credit counseling, repair service, or debt consolidation service in providing this content. Please understand that Check `n Go policies change over time. Blog posts reflect Check `n Go policy at the time of writing. While maintained for your information, archived posts may not reflect current Check `n Go policy.

The information contained in our blog posts are the author’s own opinions, not those of Check `n Go or any other company. Any pros and cons are developed by our editorial team based on independent research. Some of the products, services, and offers on this page may not be available from Check `n Go. In Texas only: Check `n Go does not act as a credit services organization in providing this content.