Finance 101

How To Calculate The Cost Of An Installment Loan: Understanding Apr And Fees

We see “APR” everywhere these days, from ads for new cars to junk mail to bank documents. So, what is APR?

APR stands for “annual percentage rate.” It represents the annual cost of borrowing money shown as a percentage. It may be different than the interest rate because it includes lender fees, interest rates and other fees. This is also why it may be considered a more complete picture of borrowing costs. APR can be constant or variable.

An APR is intended as a tool to protect consumers, giving us a bottom line for comparison between lenders. Let’s take a closer look.

How does APR work?

APR is usually expressed as an interest rate. It calculates the percentage of the principal you’ll pay each year, factoring in fees and payments. You may also see APR as the annual rate of interest paid out on investments (without accounting for compounding interest).

APR came about after the federal Truth in Lending Act (TILA) was passed in 1968 to help consumers borrowing from lenders. It required disclosures from lenders and attempted to standardize how the costs of borrowing were communicated, and the concept of APR was born. Today, TILA requires lenders show the APR they are charging borrowers to help us compare credit card offers, loan rates, and similar products.

Types of APRs

Fixed. With many personal, auto and home loans, the APR won’t change during the loan’s lifetime. While the APR you’re initially offered may change based on the index rate, once you agree to the loan’s terms, you’re locking in the rate.

Variable. Variable APRs typically occur with credit cards and adjustable-rate mortgages. A variable rate loan may start with a low interest rate that could rise in the future. With some lending, the prime rate benchmark may determine the interest rate. In these instances, if the prime rate changes your interest rate on your loan changes too. This can affect the APR (your lending costs).

Credit card lenders will sometimes offer an introductory rate. These must last six months or longer. APR may change when the introductory period is over. Credit cards may offer different rates for balance transfers, cash advances, late payments, and so on. (Keep in mind, if you pay off your credit card’s entire balance every month, you don’t pay APR or interest. These amounts are only charged on a credit card balance.)

How to calculate APR?

To calculate APR on a loan, you first need to know a few numbers:

- The total interest charges, (in your loan agreement or offer)

- Any fees, usually shown in the terms and conditions of your loan agreement

- The original loan amount, also known as principal

- The days in the loan’s term. You can calculate this using the number of years in your loan’s term. If it’s a 60-month loan, that’s five years. Multiply 365 by the years in your loan term and you’ll have the number of days.

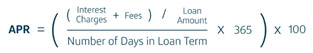

Once you have these numbers, you can use this formula to calculate the APR for a loan:

Formula courtesy of Investopedia

There are also online calculators you can use to estimate APR for a loan. But the Truth in Lending Act requires any lender offering you credit to disclose the APR. Calculating the APR for a credit card uses a different formula, but again, you can find a calculator online.

What is a good APR?

It can be hard to know what is a “good” APR. The APR you are offered depends on different factors, from your credit score to competing market rates to the prime rate. The prime rate is based on the federal funds rate from “the Fed,” or the Federal Reserve Bank. So it’s a complex question.

When the prime rate is low, you’ll sometimes see very low rates like 0% APR car loans and leases. If you see a very low rate, always check to be sure the rate lasts for the entire length of the loan. And keep in mind, the lowest rates – the ones lenders often advertise – are available only to customers with the highest credit scores.

The important thing is to compare multiple lenders. It’s the same idea as getting quotes for plumbing or painting. The more numbers you can look at, the more you get a sense of the market and how much the product you want should cost. When possible, get a quote from a lender that’s specific to your credit score and the terms you want. That way you’re comparing real numbers.

FAQs: APR

What does a 24% APR mean?

If a lender offers a 24% APR, it means the interest you’ll be charged (the amount you pay to borrow money) over 12 months will be 24% of the balance (on a credit card) or the borrowed amount, also known as principal (on a loan).

What is a good APR rate?

For a credit card, a “good” APR should be below the current average credit card interest rate. The current rate is now 20.92% according to CBS News. That’s the highest rate since the Federal Reserve started tracing APRs in 1994. Average rates are changeable and may yet increase if the Fed continues to raise interest rates.

What is the difference between APR and interest rate?

For credit cards, the APR and interest rate are the same. With a loan, the interest rate doesn’t include loan fees, but an APR tells you the full cost you’re paying to borrow your loan amount.

Definitions

- Annual Percentage Rate (APR) - Represents the annual cost of borrowing money shown as a percentage. Accounts for loan fees and simple interest.

- Compound interest - The interest you earn on interest; with compounding an amount will build exponentially, or faster over time.

- Index Rate - The index is a benchmark interest rate that reflects general market conditions.

- Interest - The cost of borrowing the principal.

- Periodic Interest Rate - The interest rate charged over a specific loan time period.

- Prime Rate - The lowest rate of interest money can be borrowed at commercially, as by banks. Usually this is the interest rate banks use to lend to the very best customers with the highest credit scores.

- Principal - The money you originally agreed to pay back.

Editorial Policy: The information contained in Check `n Go’s Finance Academy Learning Center is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Check `n Go does not act as a credit counseling, repair service, or debt consolidation service in providing this content. Please understand that Check `n Go policies change over time. Blog posts reflect Check `n Go policy at the time of writing. While maintained for your information, archived posts may not reflect current Check `n Go policy.

The information contained in our blog posts are the author’s own opinions, not those of Check `n Go or any other company. Any pros and cons are developed by our editorial team based on independent research. Some of the products, services, and offers on this page may not be available from Check `n Go. In Texas only: Check `n Go does not act as a credit services organization in providing this content.