Finance 101

Hardship Loans for the Unemployed: A Guide

Unemployed and in need of financial support? Learn how hardship loans can help you bridge the gap and what to consider before applying.

Losing a job can make it tough to keep up with daily expenses. More than a quarter of U.S. adults are struggling financially, according to Federal Reserve data from December 2023. That includes many who are “just getting by” or “finding it difficult to get by.” Hardship loans are designed to help during these difficult times by offering short-term financial support. In this blog, we’ll explain how hardship loans work, who qualifies, and what to consider before applying if you’re currently unemployed.

Can You Get a Loan if You’re Unemployed?

Being out of work doesn’t just affect your paycheck—it can take a toll on your mental health, too. Studies show that unemployment is linked to higher rates of depression, anxiety, and feelings of isolation. Many people also deal with burnout from job hunting and the added pressure of financial stress. If you didn’t have an emergency fund saved before losing your job, keeping up with bills and basic needs can feel overwhelming.

That’s where hardship loans can help. But can you get approved if you’re unemployed? The answer depends on a few things.

- Proof of income: This can include unemployment benefits, part-time gigs, freelance work, or even government aid.

- Credit history: Some lenders check your credit score, while others focus more on your ability to repay.

- Collateral: For secured loans, you may need to offer something valuable, like a vehicle or savings account, as backup.

Unemployment benefits can often count as a valid income source. If you’re doing side jobs, receiving child support, or getting money from a government program, those may help you qualify as well. While not every lender is the same, showing that you have a way to repay—even without a full-time job—can make a difference.

Types of Hardship Loans

Personal Loans from Banks or Credit Unions

- Pros: Predictable payments, lower interest if you have good credit

Cons: Harder to qualify without steady income or strong credit history

Payday Loans

- Pros: Quick access to cash, easy approval

- Cons: High fees and interest, short repayment window

Title Loans

- Pros: Fast approval, no credit check

- Cons: Risk of losing your vehicle, high interest

Government or Nonprofit Assistance Programs

- Pros: Often no repayment needed, designed for people in tough situations

- Cons: Limited availability, strict eligibility rules

Each option comes with trade-offs, so it’s important to think through what works best for your situation. If you’re unsure, consider speaking with a financial counselor or checking out local nonprofit resources before making a decision.

Alternatives to Hardship Loans

If a loan doesn’t feel like the right step, you still have other ways to get through tough times. Many people find that a mix of support programs, short-term income, and personal connections can help ease the pressure—without the extra cost of borrowing.

Assistance Programs

- Benefit: No repayment required, and they’re created specifically for people going through financial challenges.

Gig Work and Side Hustles

- Benefit: Flexibility to work on your schedule

- Consider: Some side jobs require a car, internet access, or upfront costs like supplies or background checks.

Borrowing from Family or Friends

- Benefit: May offer more flexible repayment

- Consider: Can strain relationships if expectations aren’t clearly discussed upfront

How to Apply for a Hardship Loan?

So then, how do you apply for a hardship loan if you need one? The process can vary by lender, but most follow a few basic steps—and there are ways to improve your chances of approval.

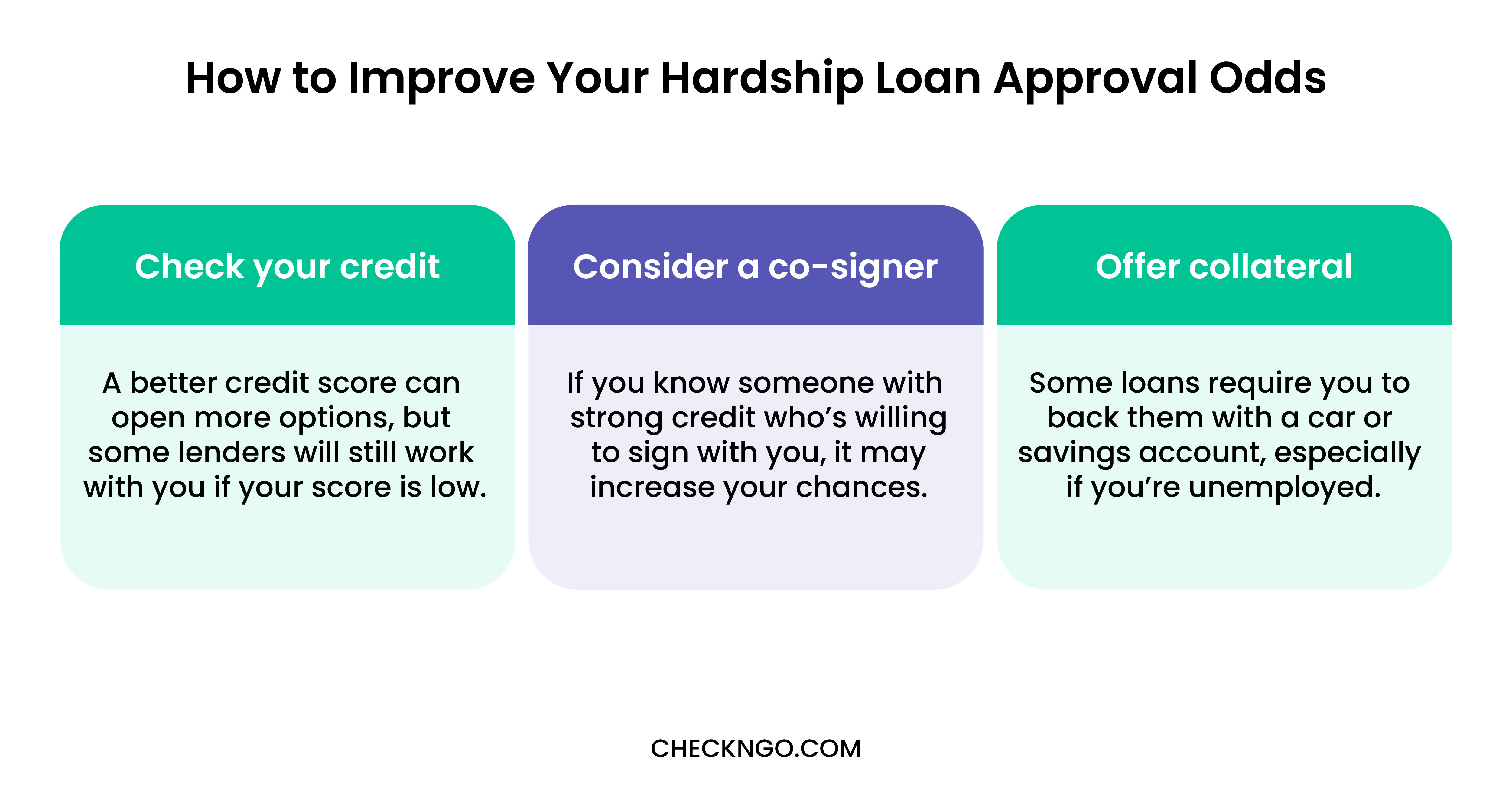

Steps to Improve Your Approval Odds

- Check your credit: A better credit score can open more options, but some lenders will still work with you if your score is low.

- Consider a co-signer: If you know someone with strong credit who’s willing to sign with you, it may increase your chances.

- Offer collateral: Some loans require you to back them with a car or savings account, especially if you’re unemployed.

Documents You May Need

- Proof of identity (ID or driver’s license)

- Income statements (unemployment benefits, freelance work, etc.)

- Bank statements

- Social Security number or tax ID

- Details about your monthly expenses

Tips for Responsible Borrowing

- Only borrow what you truly need

- Read the loan terms carefully, including fees and repayment schedule

- Create a repayment plan before you accept the loan

- Ask questions if anything is unclear

Potential Risks to Watch For

- High interest rates and fees: These can make it hard to repay the loan

- Short repayment windows: Some loans expect repayment within weeks

Scams: Be cautious of lenders who ask for upfront fees or offer deals that seem too good to be true

Applying for a hardship loan is a serious decision, so take your time, gather your documents, and look closely at the terms before signing anything.

Finding Financial Help When You Need It Most

Editorial Policy: The information contained in Check `n Go’s Finance Academy Learning Center is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Check `n Go does not act as a credit counseling, repair service, or debt consolidation service in providing this content. Please understand that Check `n Go policies change over time. Blog posts reflect Check `n Go policy at the time of writing. While maintained for your information, archived posts may not reflect current Check `n Go policy.

The information contained in our blog posts are the author’s own opinions, not those of Check `n Go or any other company. Any pros and cons are developed by our editorial team based on independent research. Some of the products, services, and offers on this page may not be available from Check `n Go. In Texas only: Check `n Go does not act as a credit services organization in providing this content.