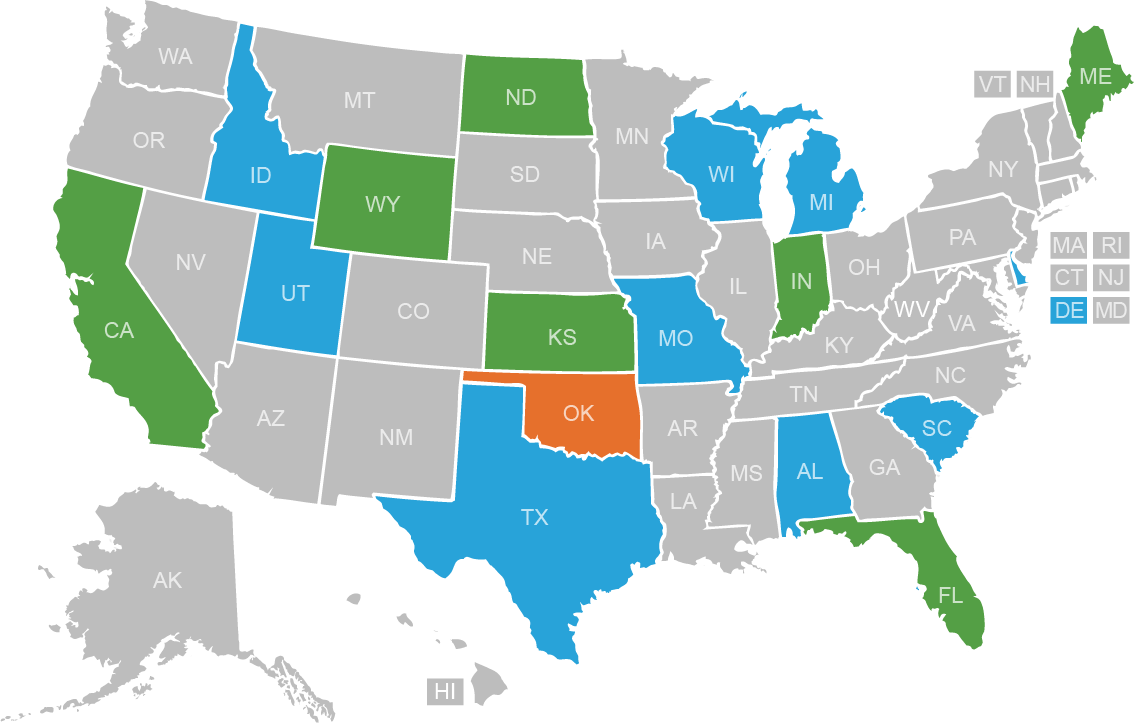

PRODUCT AVAILABILITY

Products, rates, and terms by state.

ONLINE AND

RETAIL PRODUCTS

ONLINE ONLY

PRODUCTS

RETAIL

PRODUCTS

Loans Rates and Terms by State

Select your state below to view important rates, terms, and disclosures unique to the state.

You Can Count on Check `n Go